As 2013 comes to a close, most will remember the year of large crops across the globe and the market that began to shift back to the favor of the buyer. The Southern Hemisphere produced record crops in several markets, and with the exception of France, growers in the Northern Hemisphere experienced bountiful harvests as well. Buyers returned to the market in full force, taking advantage of pricing that had not been seen in recent quarters. Despite reports of potential global wine shortages, the market ends the year 2013 in a balanced to long position.

As 2013 comes to a close, most will remember the year of large crops across the globe and the market that began to shift back to the favor of the buyer. The Southern Hemisphere produced record crops in several markets, and with the exception of France, growers in the Northern Hemisphere experienced bountiful harvests as well. Buyers returned to the market in full force, taking advantage of pricing that had not been seen in recent quarters. Despite reports of potential global wine shortages, the market ends the year 2013 in a balanced to long position.

This Coffee Shop article is an excerpt from the Ciatti Global Wine & Grape Brokers’ Global Market Update (Volume 5 Issue No. 1). Here, we focus on the California section of the report. See the full report for global wine market update for countries including Argentina, Australia &New Zealand, Chile, France, Germany, Italy, South Africa, and Spain.

Demand continues to be strong for wine in many markets, and wineries were able to weather the storm of higher bulk pricing in 2011 and 2012. Margins were squeezed, and many struggled with price increases. Hopes are that growth will continue with ample supply to meet future demand. The team at the Ciatti Company thanks you for your support during the 2013 year, and we wish everyone a successful 2014.

California Report

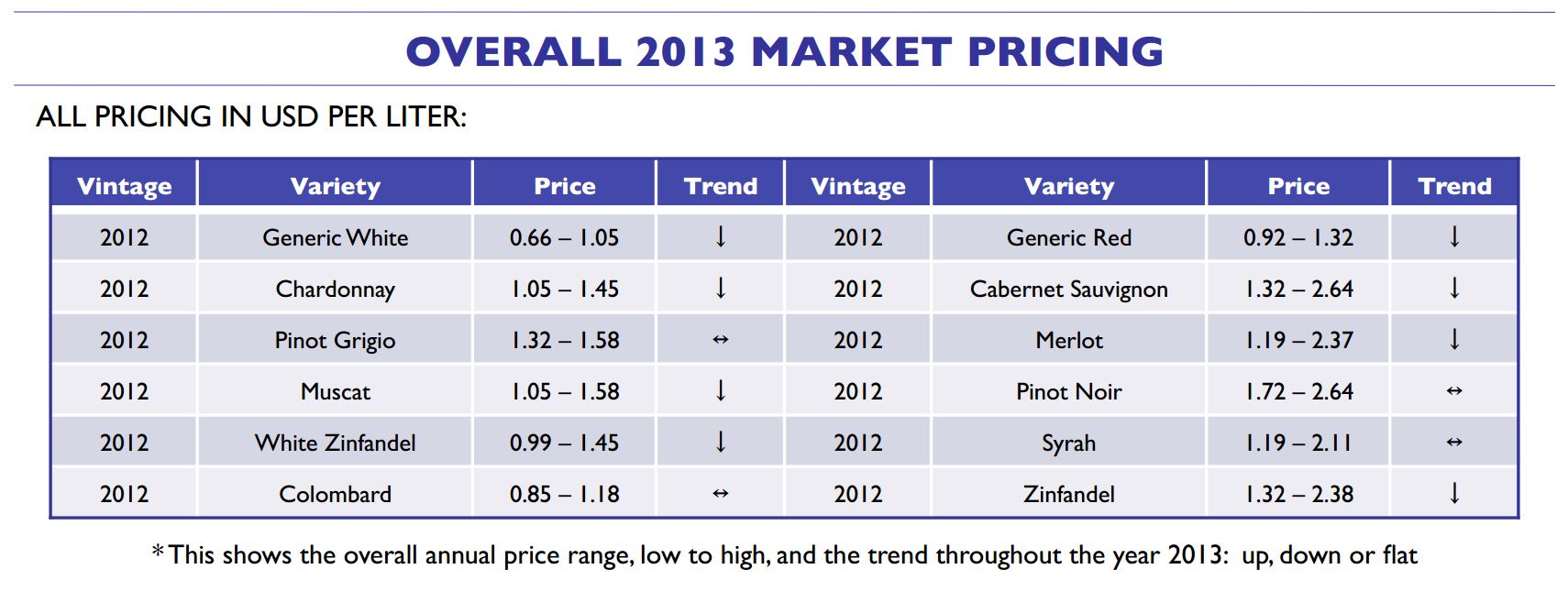

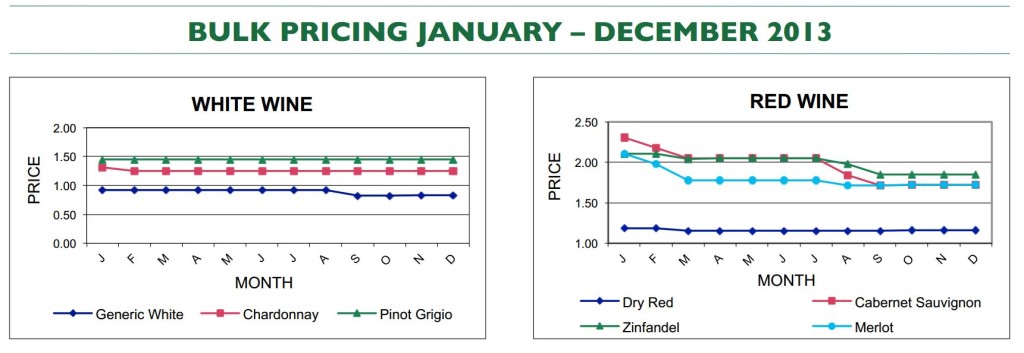

The 2013 wine and grape industry in the United States showed many similar conditions to that of 2012. Another large harvest of outstanding quality caused additional capacity constraints. As in 2012, there was more retooling of vineyards, both existing and on new ground. 2013 showed sales growth at modest levels, with case good imports leading the way. 2013 did, however, regain growth in US wine exports to international markets, as supply is now available. Bulk wine imports declined, as expected, given the bountiful US harvests. It seems that big wineries continue to get bigger, and most wineries are seeing high sales and performance numbers. Meanwhile, tank builders are busier than ever, delivering to wineries throughout California .

Projections for 2014

In 2014, producers will aggressively market excess wines to all potential buying opportunities, both domestic and international. Pricing on excess bulk inventories will continue to decrease, given the added volume and competitive environment. Pricing on grapes will not see as large of a downward swing until additional vineyards enter production.The current cyclical drought conditions in the western US will cause industry concerns for future vintages. This will also spur the continued regulatory and legislative discussions about water restrictions to all California agriculture.