Premiumization. It’s a word that prevails today when attempting to describe a main characteristic of the wine business. You won’t find this word in the Merriam-Webster, Cambridge or Oxford Dictionaries, but according to Wiktionary on-line, it’s “The move toward more expensive premium products.” Specifically, this word in the wine business describes the idea that consumers are demanding “better” and are willing to pay for it, or as we commonly say, “They are moving up the price chain.” Sales data continues to show that consumers seem willing to pay more for [an assumedly] more enjoyable experience. It goes hand in hand with the continued affluence of this nation over the long term, but also manifests itself short term in conjunction with the perceived health of the economy.

Premiumization. It’s a word that prevails today when attempting to describe a main characteristic of the wine business. You won’t find this word in the Merriam-Webster, Cambridge or Oxford Dictionaries, but according to Wiktionary on-line, it’s “The move toward more expensive premium products.” Specifically, this word in the wine business describes the idea that consumers are demanding “better” and are willing to pay for it, or as we commonly say, “They are moving up the price chain.” Sales data continues to show that consumers seem willing to pay more for [an assumedly] more enjoyable experience. It goes hand in hand with the continued affluence of this nation over the long term, but also manifests itself short term in conjunction with the perceived health of the economy.

The Economy

This summer I spoke at two important meetings in Lodi regarding Lodi’s position in the larger wine world. It seems Lodi growers are eager to know where they fit in. Folks ask questions like, “What does the future hold for the winegrape business in Lodi?” and “Is Lodi poised to provide grapes for premium wines priced at $10 and above or will Lodi find itself supplying the lower end of the California market as Central Valley winegrapes decrease in volume over time due to competition from alternative crops and cheap foreign wine?” There’s no for sure answer to these questions because so many factors can influence the outcome, but the one thing I consistently tell people who want a crystal ball outlook is that their answer comes mainly from the U.S. economy.

If someone can define the strength of the economy at any point in the future, I can tell them with a high degree of confidence how the wine market will be performing at that same time. What this means for Lodi is that as long as the economy is “strong”, it is likely consumers will be willing to pay more for wine, which means there will be opportunity for Lodi to enjoy the demand associated with this. So, more and more we find ourselves looking at economic indicators to forecast performance of the wine business. But arguably more important than various indicators of economic performance is the actual perception of economic strength by consumers, and for that we turn to the Consumer Confidence Index® (CCI).

Consumer Confidence

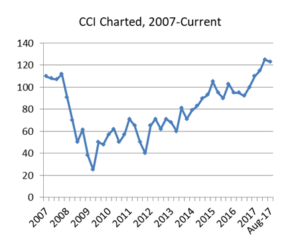

The Conference Board’s CCI is an indicator designed to measure consumer confidence, which is defined as the degree of optimism on the state of the economy that consumers are expressing through their activities of savings and spending. The CCI is calculated each month on the basis of a household survey of consumers’ opinions on current conditions and future expectations of the economy. Opinions on current conditions make up part of the index (Present Situation), with expectations of future conditions (Expectations Index) comprising the majority of it. As of the August 2017 report, the Index stood at 122.9 (indexed to 1985=100). The Present Situation Index was at 151.2, while the Expectations Index was at 104.0 for August.

What do these numbers mean? In short, they mean that consumers are more optimistic about their current and future situations than “normal.” For some time now, consumer confidence has been strengthening. The CCI has steadily improved since the recession of 2008-2009 where it hit an all-time low of about 25. Where it sits today is about as high as it has been since early 2001. Coupled with improving (and now strong) consumer confidence has been the incredible increase in shipments of wines above $7/bottle. It should be no surprise that these two things go hand in hand.

Premiumizing Lodi

Lodi is often referred to as the “sweet spot” in the wine business, because of its unique ability to produce premium quality wines while still displaying affordability, and simply put – value. But this position also means that there will always be opportunities/pressures from the upper and lower ends of the market. In recent years, the upper end of the market has been rebounding from the effects of the recession. Wines above $10/bottle were struggling prior to 2011, as recession-thrifty consumers were looking for cheaper alternatives. Since 2011, large coastal crops and carry-in inventory have satisfied the market’s need for premium wine supply, as it has grown definitively. With the onset of the 2017 harvest, the broader coastal winegrape market finally seemed to find its balance on supply. Assuming no major changes in consumer behavior or outrageously large coastal crops, this will slowly open up opportunities for Lodi grapes to become a larger part of the premiumization trend in the future, as premium buyers look to keep costs under control and extend the volumes of their blends.

“Below” Lodi (figuratively and literally) is the Central Valley. The Central Valley has experienced challenging times in the wine business in recent years as foreign competition and premiumizing consumers have displayed less interest in wines from the region. This has kept supply pressure on Lodi, as there have been an abundance of grapes available just beneath it. With a handsome amount of Central Valley vineyard removals and shorter than normal crops the last few years, the burdensome effects of Central Valley supply are diminishing for Lodi. This trend, much like that of the coast, bodes well for Lodi and the ability to premiumize via a strengthening market for grapes. There’s less supply pressure from the bottom and more demand potential from the top. Lodi’s position moving into the future looks favorable.

What’s a Grower to do?

At this point, I’m sure many are reading this thinking, “What can I do to control any of this?” You may not be able to control the economy, consumer behavior or grape supply, but you can position yourself for the opportunity that appears will exist. There may be some measures you can take to open up opportunities for increased grape pricing due to premiumization.

Initially, ask your current grape buyer if there is an opportunity to receive more dollars per ton by moving into a higher-priced wine program, if one exists. This may sound obvious, or you may think you already know the answer, but the reality is that if you aren’t positioning yourself for (or asking for) more money from your buyer, then you probably won’t get it. Coupled with any opportunity to move up in price will be an obligation to perform – possibly meaning you will need to spend additional money on cultural costs, etc. However, many growers are already doing a great job viticulturally and are under-compensated for their grapes, simply because they have failed to ask the question or look for alternative sales opportunities.

One such alternative sales opportunity is to take grapes to the next level and make wine to sell in bulk. Another option is to grow premium grapes and pursue “premium” buyers as opposed to growing as a commodity and pursuing “commodity” buyers. On the surface, these may sound implausible, but in reality there exists very convenient ways to take your grapes to the next level with professionals in the business that can guide and direct such efforts with very little additional cost. Keep in mind, this does not have to be done with your entire production (nor is it necessarily recommended). Maintaining stability by keeping grapes under a current marketing arrangement is important for obvious reasons. Creating new opportunities and relationships takes time, so don’t expect overnight changes.

Many buyers are looking to expand their grape supply by venturing into new regions, where premium fruit may be more affordable. In addition, some buyers only buy wine and do not have the ability (facility-wise or time-wise) to buy and process grapes. The bulk wine market, as commonly defined in volume, only represents about 3-4% of the winegrape crush, but this tiny segment of the market is an important place to find opportunity by showcasing the true quality of one’s grapes/wine. There have been many instances of growers making wine from their grapes and subsequently opening up opportunities to sell to premium buyers for the future, both in the form of grapes and wine.

As in all areas of life, bettering one’s situation takes time and effort. There will always be factors that exist that are out of our control. But when opportunity does exist, it is imperative to take action to capitalize as opposed to simply waiting for something good to happen spontaneously. The trends are in Lodi’s favor. There’s plenty of reason for bullishness and optimism, but it’s up to us, as growers, to facilitate an improved situation for ourselves.

Have something interesting to say? Consider writing a guest blog article!

To subscribe to the Coffee Shop Blog, send an email to stephanie@lodiwine.com with the subject “blog subscribe.”

To join the Lodi Growers email list, send an email to stephanie@lodiwine.com with the subject “grower email subscribe” or click on “join our email list” to the right.

To receive Lodi Grower news and event promotions by mail, send your contact information to stephanie@lodiwine.com or call 209.367.4727.

For more information on the wines of Lodi, visit the Lodi Winegrape Commission’s consumer website, lodiwine.com.